8171 payment 2025

If you’re a small business owner in Punjab looking to scale up your operations, the Punjab government has just made it easier for you. Introducing the CM Punjab Asaan Karobar Card, a groundbreaking initiative led by Chief Minister Punjab Maryam Nawaz Sharif. Designed with small entrepreneurs in mind, this program aims to empower startups and small businesses with interest-free loans of up to Rs. 1 million.

Here’s the kicker: these loans come with flexible repayment terms spread over three years. Plus, this program is inclusive, welcoming applications from men, women, transgenders, and individuals with special needs, ensuring equal opportunities for all. Let’s dive into how you can apply, who qualifies, and why this initiative is a game-changer for the entrepreneurial landscape in Punjab.

ادائیگی 2025

اگر آپ پنجاب میں ایک چھوٹے کاروباری مالک ہیں اور اپنے کاروبار کو بڑھانا چاہتے ہیں، تو پنجاب حکومت نے آپ کے لیے یہ کام آسان کر دیا ہے۔ وزیراعلیٰ پنجاب مریم نواز شریف کی قیادت میں ایک انقلابی اقدام، “سی ایم پنجاب آسان کاروبار کارڈ” متعارف کرایا گیا ہے۔ چھوٹے کاروباری افراد کے لیے تیار کردہ، یہ پروگرام اسٹارٹ اپس اور چھوٹے کاروباروں کو 10 لاکھ روپے تک بلا سود قرضے فراہم کرکے بااختیار بنانے کا مقصد رکھتا ہے۔

اس کی خاص بات یہ ہے کہ یہ قرضے تین سال میں واپس ادائیگی کے لچکدار شرائط کے ساتھ دستیاب ہیں۔ مزید یہ کہ یہ پروگرام جامع ہے، جس میں مرد، خواتین، transgender افراد اور خصوصی ضروریات کے حامل افراد کی درخواستیں خوش آمدید ہیں، تاکہ سب کو یکساں مواقع فراہم کیے جا سکیں۔ آئیے جانتے ہیں کہ آپ درخواست کیسے دے سکتے ہیں، کون اہل ہے، اور یہ اقدام پنجاب کے کاروباری منظر نامے کے لیے کیوں ایک انقلابی قدم ہے۔

What Is the Asaan Karobar Card Program All About?

The Punjab government has committed a hefty Rs. 48 billion to fuel this initiative, reflecting its dedication to uplifting small businesses. What sets this program apart is the ease it offers—applicants can repay the loans in manageable installments while utilizing the funds exclusively for business purposes.

Whether you’re running a startup or a small business, this program is tailored to give your venture the financial boost it needs. By the end of this article, you’ll know exactly how to apply for this loan online and leverage the opportunity to expand your business.

Who Can Apply? (Eligibility Criteria)

Before diving into the application process, let’s take a quick look at who qualifies for this program:

- Residents of Punjab: Applicants must hold a valid CNIC with a permanent Punjab address.

- Age Range: You must be between 21 and 57 years old.

- Entrepreneurs Only: This program is open to small business owners in Punjab.

- Tax Filer Status: You must be an active tax filer.

- SIM Ownership: Your phone number must be registered under your name.

If you tick all these boxes, you’re ready to proceed with the application.

کون درخواست دے سکتا ہے؟ (اہلیت کے معیارات)

درخواست کے عمل میں جانے سے پہلے، آئیے ایک نظر ڈالتے ہیں کہ اس پروگرام کے لیے کون اہل ہے:

پنجاب کے رہائشی: درخواست دہندگان کے پاس پنجاب کے مستقل پتے کے ساتھ ایک درست CNIC ہونا ضروری ہے۔

عمر کی حد: درخواست دہندگان کی عمر 21 سے 57 سال کے درمیان ہونی چاہیے۔

صرف کاروباری افراد: یہ پروگرام پنجاب کے چھوٹے کاروباری مالکان کے لیے کھلا ہے۔

ٹیکس فائلر کی حیثیت: آپ کو ایک فعال ٹیکس فائلر ہونا ضروری ہے۔

SIM کی ملکیت: آپ کا فون نمبر آپ کے نام پر رجسٹرڈ ہونا چاہیے۔

اگر آپ ان تمام شرائط پر پورے اترتے ہیں، تو آپ درخواست دینے کے لیے تیار ہیں۔

How to Apply Online for the Asaan Karobar Card

Applying for this program is super easy and can be done from the comfort of your home. Just follow these simple steps

Visit the Official Website

Head to the Punjab Government’s official Asaan Karobar Card portal

Register an Account

- Click the “Register Now” button.

- Fill in your details, including:

- Name

- Father’s Name

- CNIC Number

- Date of Birth

- CNIC Issue and Expiry Dates

- Mobile Number

- A secure password

- Once completed, hit “Create Account.”

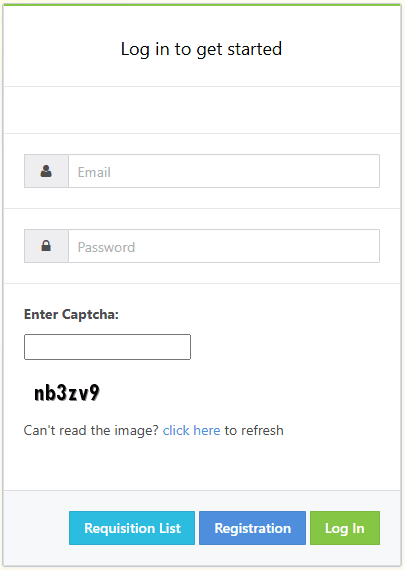

Log In to Your Account

After registering, log in using your CNIC and password.

Fill Out the Application Form

The application form is divided into four sections:

- Personal Details

- Business Details

- Loan Details

- Document Uploads

Submit Your Application

Once the form is complete, click “Submit.” You’ll receive a challan for a non-refundable processing fee of Rs. 500. Pay this fee immediately to ensure your application is processed.

Loan Usage and Repayment Terms

One of the standout features of the Asaan Karobar Card is its clear and structured repayment plan:

- First 50% Limit: You can access half of the loan amount in the first six months, but only for business-related expenses. Personal or nonessential transactions are strictly prohibited.

- Grace Period: No repayments are required during the first three months after receiving the loan.

- Monthly Installments: Starting in the fourth month, you’ll pay just 5% of the outstanding loan as a monthly installment.

- Second 50% Limit: Once you’ve demonstrated responsible usage of the first half and made regular repayments, you’ll gain access to the remaining 50%.

To maintain eligibility for the second installment, borrowers must also register with PRA or FBR. The remaining balance can be paid in Equated Monthly Installments (EMIs) over two years, ensuring flexibility for entrepreneurs.

Why This Program Matters

The Asaan Karobar Card Program is more than just a financial aid initiative—it’s a lifeline for small businesses. With interest-free loans and user-friendly terms, it eliminates many barriers that entrepreneurs face when seeking capital. Plus, its inclusivity ensures that everyone, regardless of gender or ability, gets a fair shot at achieving their entrepreneurial dreams.

Final Thoughts

- If you’re a small business owner in Punjab, this is your chance to take your venture to the next level. The CM Punjab Asaan Karobar Card offers a unique opportunity to secure funding without the burden of interest, empowering you to focus on growth and innovation.

- Visit the official website today and follow the simple application process to get started. Have questions? Drop them in the comments below, and we’ll help you out!

- Make the most of this initiative and turn your business dreams into reality.

FAQs

- Who is eligible to apply for the Asaan Karobar Card?

Anyone who is a permanent resident of Punjab, aged between 21 and 57, running a small business or startup, and an active tax filer can apply. The program also welcomes applications from men, women, transgenders, and individuals with special needs. - How much loan can I get under this program?

You can apply for an interest-free loan ranging from Rs. 100,000 to Rs. 1 million, depending on your business needs and eligibility. - Can I use the loan for personal expenses?

No, the loan is strictly for business-related expenses. Nonessential transactions, like personal use or entertainment, will be blocked to ensure the funds are utilized appropriately. - What are the repayment terms?

The first 3 months are a grace period, with no installment payments required.

After that, you’ll pay a minimum of 5% of the outstanding amount as monthly installments.

The loan must be fully repaid within 3 years.

One Comment